All Categories

Featured

Table of Contents

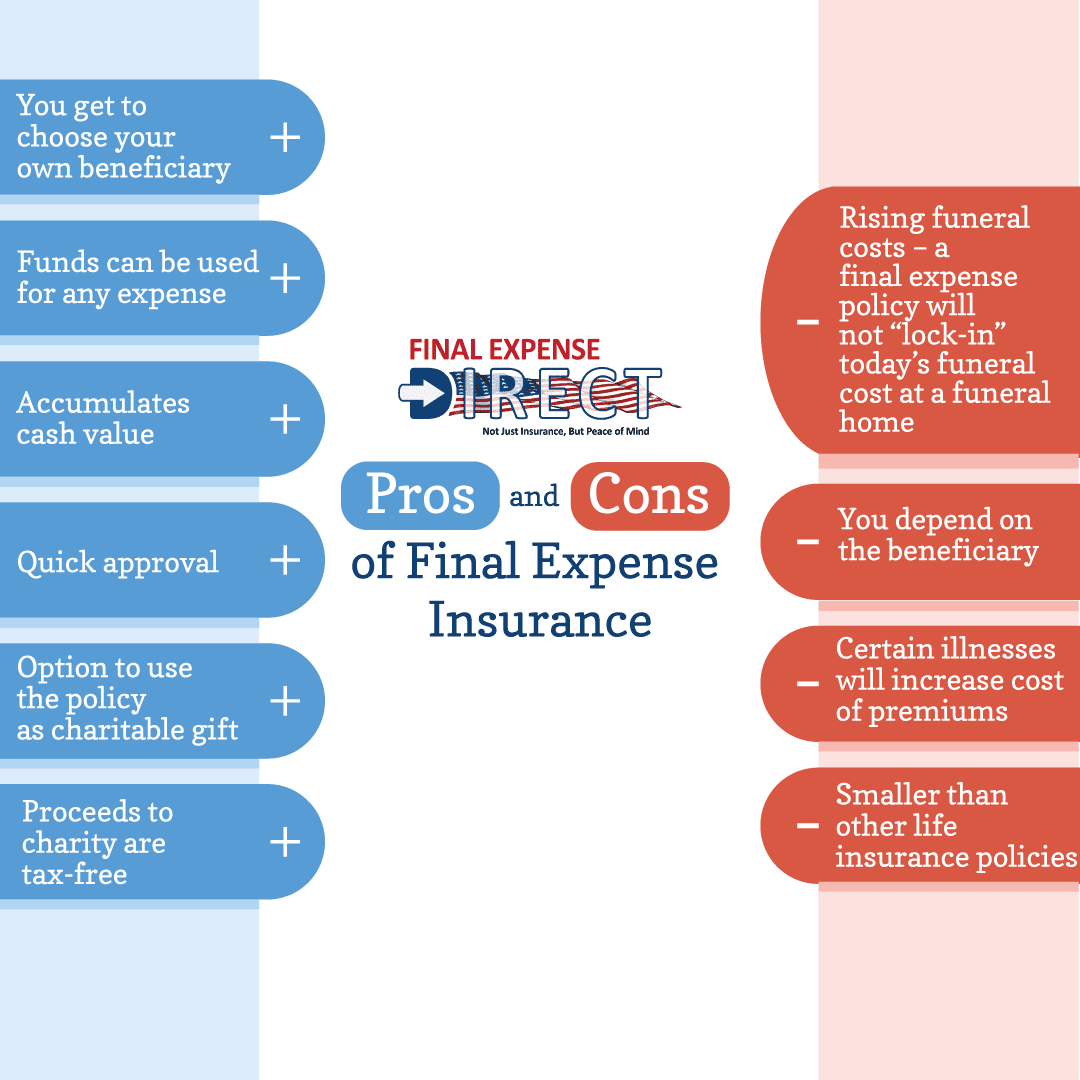

Similar to other life insurance policy plans, if your customers smoke, utilize various other kinds of tobacco or nicotine, have pre-existing health and wellness problems, or are male, they'll likely have to pay a greater price for a final expenditure plan (funeral expense benefits for seniors). The older your client is, the greater their rate for a strategy will be, considering that insurance coverage companies think they're taking on more risk when they use to insure older customers.

That's due to the fact that last cost plans have degree (or "fixed") premiums. The policy will certainly likewise continue to be active as long as the policyholder pays their premium(s). While numerous other life insurance policy policies might require medical examinations, parameds, and going to doctor statements (APSs), last expenditure insurance coverage do not. That's one of the great aspects of final expenditure strategies - online funeral insurance.

Final Expense Insurance Quotes

Simply put, there's little to no underwriting called for! That being said, there are two major kinds of underwriting for last cost strategies: simplified issue and ensured concern. funeral insurance rates. With streamlined issue strategies, customers normally just have to address a couple of medical-related concerns and may be denied coverage by the service provider based on those responses

For one, this can enable agents to determine what kind of plan underwriting would work best for a specific customer. And 2, it assists agents limit their client's choices. Some carriers may invalidate customers for protection based upon what drugs they're taking and just how long or why they have actually been taking them (i.e., maintenance or treatment).

Selling Burial Insurance

A last cost life insurance policy is a kind of permanent life insurance policy. funeral life. While this policy is made to help your recipient pay for end-of-life expenditures, they are cost-free to use the death benefit for anything they need.

Similar to any type of other irreversible life policy, you'll pay a routine costs for a last cost plan in exchange for an agreed-upon survivor benefit at the end of your life. Each service provider has various policies and options, yet it's fairly easy to handle as your recipients will certainly have a clear understanding of exactly how to invest the cash.

You might not require this sort of life insurance policy (what is the difference between life insurance and burial insurance). If you have long-term life insurance policy in position your last costs may already be covered. And, if you have a term life policy, you may be able to transform it to a permanent plan without some of the extra steps of obtaining final cost insurance coverage

Final Expense Insurance

Created to cover limited insurance policy needs, this kind of insurance policy can be an economical option for people that just desire to cover funeral prices. (UL) insurance remains in place for your whole life, so long as you pay your costs.

This alternative to final expense insurance coverage gives options for additional household coverage when you require it and a smaller sized insurance coverage quantity when you're older. state farm final expense life insurance.

Neither is the idea of leaving liked ones with unanticipated costs or financial obligations after you're gone. funeral cover online quote. Consider these five realities concerning last costs and exactly how life insurance policy can aid pay for them.

Latest Posts

Compare Funeral Covers

Best Insurance To Cover Funeral Expenses

Sell Funeral Plans